Custom Web App for Willows Finance to Automate the Secured Loan Solutions

Project Goal

Introduction

Willows Finance is a specialized UK-based secured loans broker offering tailored solutions to meet individual financial needs. With expertise in secured loans, bridging finance, and mortgage options, Willows Finance prides itself on delivering personalized and transparent financial advice. The website features a user-friendly interface, making it easy for clients to explore various loan products, understand eligibility criteria, and access professional guidance.

Client Requirement

Willows Finance needed a Custom Web Application to automate and improve their existing processes for managing leads in their mortgage, secured loans, and homeowner loan services.

They wanted to enhance their workflow by integrating the application with their Insightly CRM, using APIs to automatically handle the submission of leads to various finance vendors like Pepper Money, StepOne Finance, Evolution Money, and InterBridge.

Their main requirement was that they wanted a dedicated admin panel that would not only simplify the existing process but also automate tracking and reporting, resulting in significant improvements in productivity and organization.

Vision

Our goal with this project is to give Willows Finance a custom web application that seamlessly automates the lead submission process, enhancing efficiency and accuracy.

By integrating with the Insightly CRM platform, the application will automate processes, enabling fast submissions to multiple vendors while providing real-time tracking and comprehensive reporting. This automation streamlines operations and reduces manual work, ensuring greater efficiency.

This solution aims to optimize operations, reduce manual effort, and ensure Willows Finance can deliver timely and effective financial solutions to its clients.

Tech Stack

Frontend: React.JS

Backend: Laravel (Version 9)

Database: MySQL (Version 8.0)

Solution

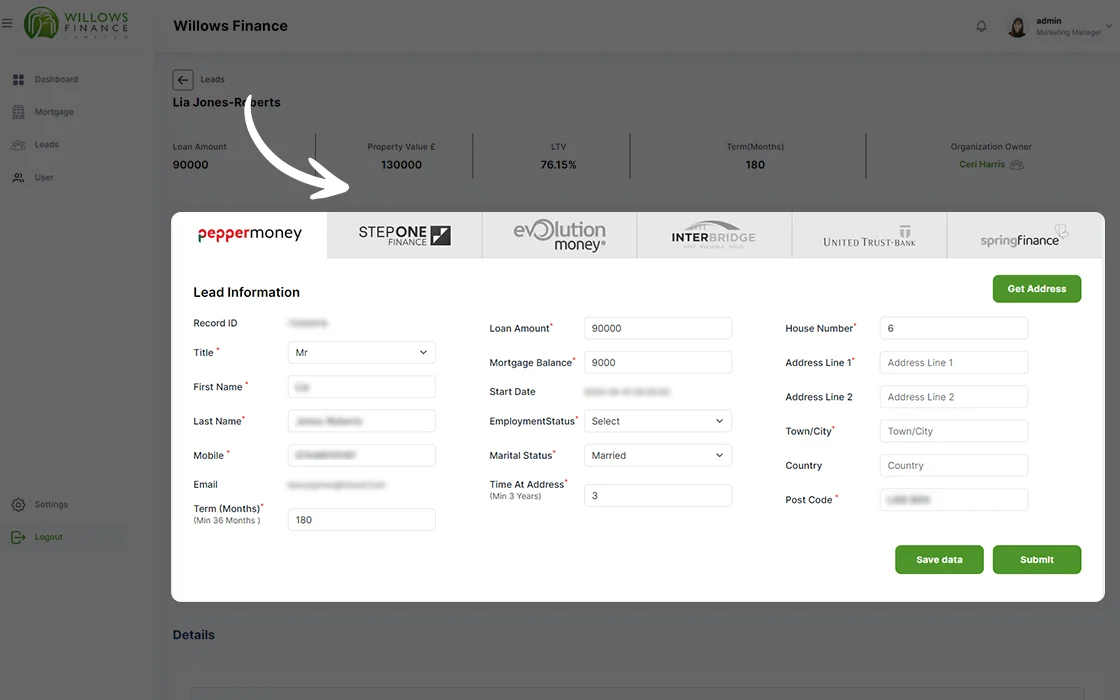

We designed a user-friendly interface using React.JS to address the client’s requirements. This design makes managing and tracking leads simple, with easy navigation and quick access to key features, so submitting leads is effortless.

On the backend, we connected the application with Insightly CRM APIs to automatically fetch customer records. We also set up the system to send leads to various finance platforms like Pepper Money, StepOne Finance, Evolution Money, and InterBridge through their APIs. We conducted thorough quality assurance tests to ensure everything worked smoothly and then deployed the application to a live environment for real-time use.

This approach not only simplifies the whole existing process but also boosts efficiency and accuracy, helping Willows Finance serve their clients better.

How Our Application Simplifies Working with Top Finance Platforms?

The custom application we developed for Willows Finance is designed for the automation of their secured loan process by integrating with several leading finance platforms. This integration allows for automatic and efficient submission of leads, streamlining the process and ensuring that each lead is handled promptly. Here’s how our application helps you work seamlessly with each finance platform:

Pepper Money

Pepper Money provides tailored lending solutions to a diverse range of clients, including those with complex financial needs. By integrating with Pepper Money’s API, our application ensures that leads are submitted directly to their system, facilitating a smoother application process and faster response times.

StepOne Finance

StepOne Finance offers a variety of financial products with a focus on simplicity and accessibility. The integration with StepOne Finance’s API enables our application to seamlessly forward leads, making it easier to handle loan applications and streamline the approval process.

Evolution Money

Evolution Money specializes in providing flexible lending options for a broad customer base. By connecting with Evolution Money’s API, our application automatically sends leads to their platform, ensuring efficient handling of loan applications.

InterBridge

InterBridge is known for its comprehensive financial solutions and efficient processing systems. Our integration with InterBridge’s API allows for the direct submission of leads, ensuring that they are quickly and effectively managed, which enhances the overall efficiency of the lead management system.

Key Features of this Web Application

Check out the standout features of our web application! From smooth integrations with top finance platforms to real-time tracking and automated lead management, these features are designed to make your job easier and more efficient.

Real-Time Lead Management

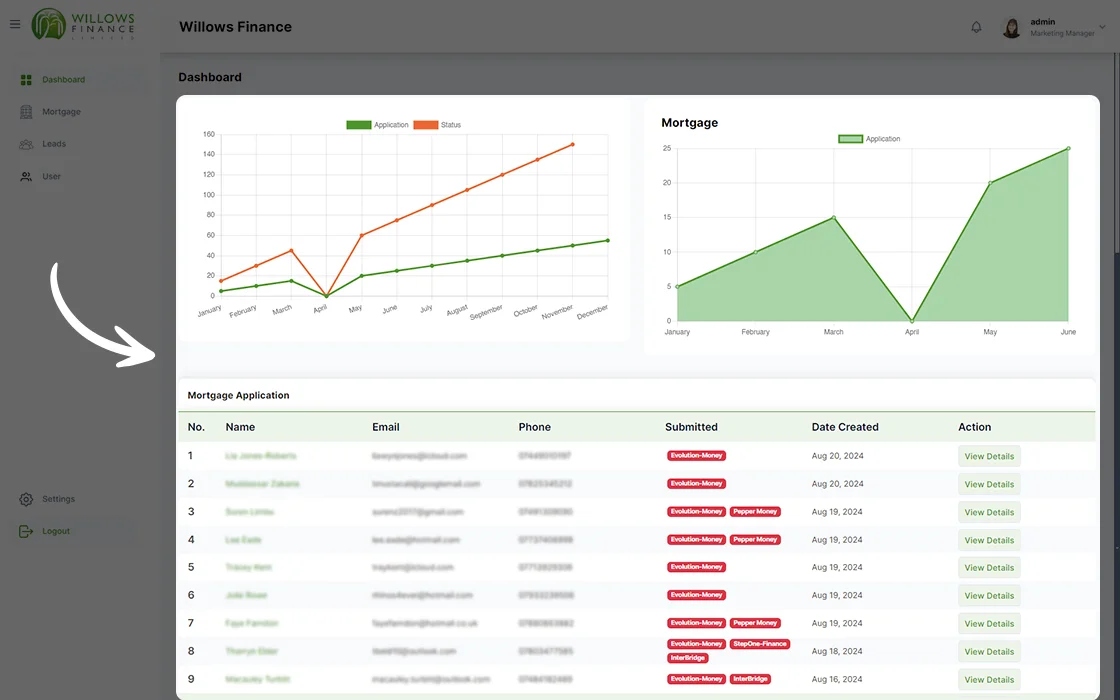

The application allows for real-time updates and management of leads, ensuring that the admin can monitor and track leads efficiently. This feature reduces the time lag between lead generation and action, enabling quicker responses and better customer service.

Detailed Tracking

Each lead’s status can be tracked in detail, providing insights into the progress and actions taken by various vendors. This transparency helps in identifying bottlenecks and improving the overall lead conversion process. The detailed tracking also includes timestamps and action logs, which are crucial for auditing and performance analysis.

Seamless Integration

The application integrates seamlessly with Insightly CRM and multiple finance platforms, automating the lead submission process. This integration eliminates the need for manual data entry, decreasing errors and saving time. The seamless data flow between systems ensures that all stakeholders have access to up-to-date information.

User-Friendly Interface

The intuitive design ensures that users can easily navigate and utilize the application without extensive training. The interface includes features like drag-and-drop functionality, real-time notifications, and customizable dashboards, making it adaptable to the user’s needs and preferences.

Comprehensive Dashboard

The dashboard provides a comprehensive view of all activities, including revenue trends and mortgage applications, enhancing decision-making capabilities. The visual representation of data through graphs and charts helps in quickly understanding key metrics and performance indicators. The dashboard is also customizable, allowing users to focus on the most relevant information.

Final Words

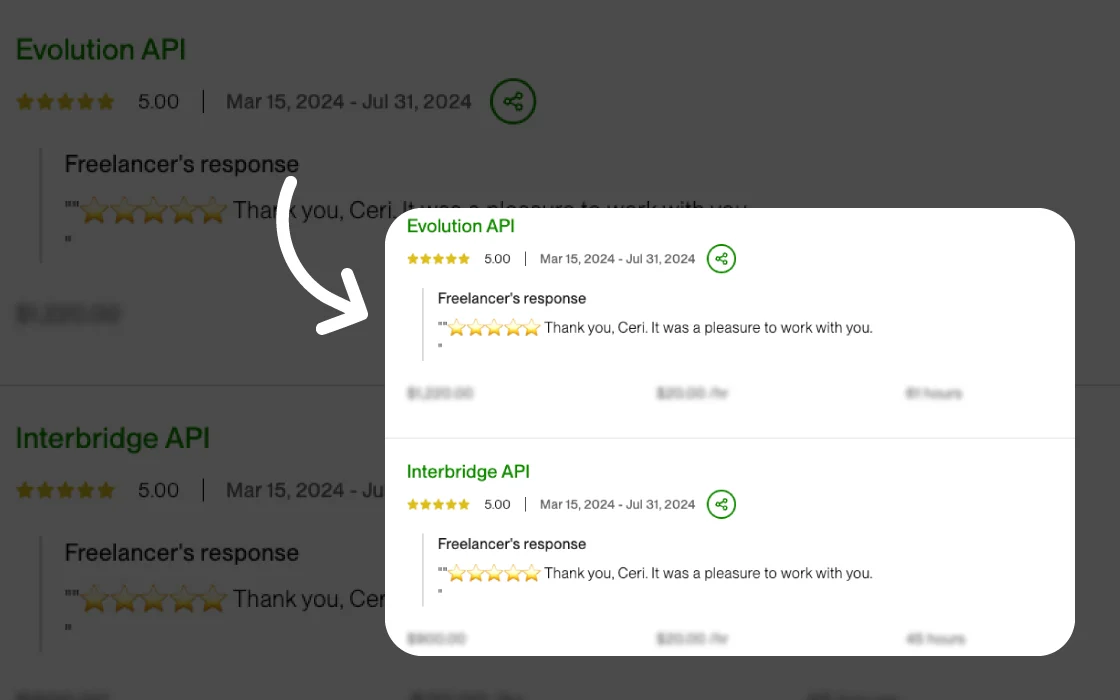

With our custom web application, we’ve transformed the working of Willow Finance. By automating data transfer and integrating seamlessly with Insightly CRM and major finance platforms like Pepper Money, StepOne Finance, Evolution Money, and InterBridge, we’ve significantly improved their secured loan solutions.

The application not only streamlines submissions but also provides real-time insights and enhances operational efficiency. We’re proud of the impact this project has had and excited about future opportunities to support Willows Finance in achieving their business goals.